)

Banks often keep their home loan interest rate low for women borrowers compared to men borrowers. A lower interest rate makes a great impact on Equated Monthly Instalments (EMIs) and provides significant savings over the longer tenure of the home loan.

A majority of the state government encouraged home ownership by women and thus they provide a significant rebate on registration fee/stamp duty if the property is registered in the name of a lady. Home loan benefits for females include lower stamp duty charges by 1-2%. A woman can thus save up to Rs 1,60,000 on registration of a property worth up to Rs 80 lakh.

The existing rules allow a woman to apply as co-borrowers with their spouses. If both are working professional, then their combined income can make them eligible for a higher loan and thus gives them more flexibility in choosing a suitable home for their family.

Just like men, women are also eligible for enjoying a tax deduction on home loan repayments. The maximum deduction allowed in principal as well as the interest at Rs 1.5 lakh and Rs 2 lakh respectively.

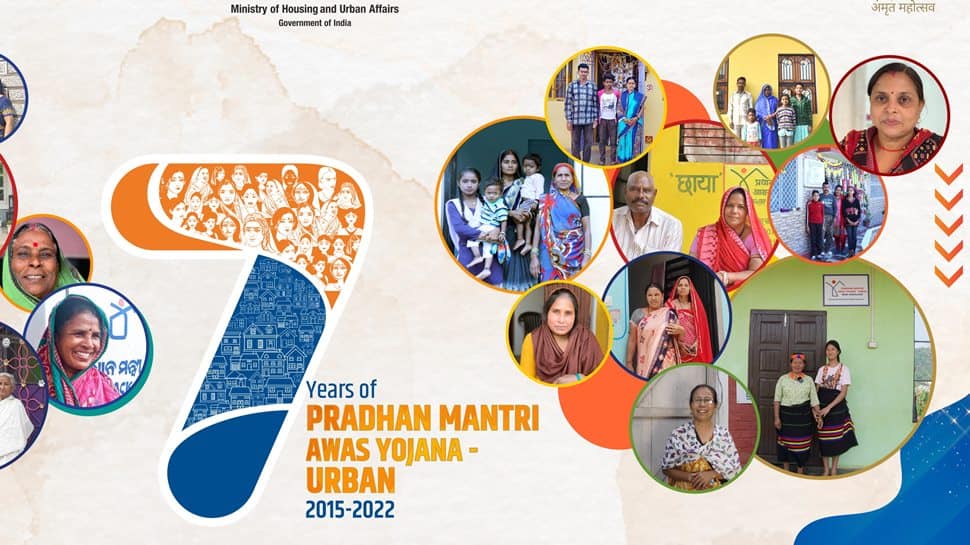

Pradhan Mantri Awas Yojana is a game-changer initiative for home buyers. The PMAY makes female co-ownership mandatory for the female head of the family. When it comes to the Economically Weaker Section (EWS) and Low Income Group (LIG) category, the PMAY scheme preference is extended to widows as well as single women.